- The Startup Breakdown

- Posts

- BRICS is VC’s Worst Nightmare

BRICS is VC’s Worst Nightmare

Baidu venture's exit from American market reminder of tension building in Sino-US relations

This is The Startup Breakdown, the newsletter where we learn, laugh, and love startups. By joining this growing community of hundreds of future startup aficionados (think i spelled that right?), you're getting a beachside view of the ocean that is the startup and VC scene. This ain’t your grandpa’s newsletter, so prepare yourself for an inbox full of 4/20 jokes and Succession references.

If you'd like to receive these newsletters directly in your inbox once a week, hit subscribe and never miss an email!

Love what you're reading? Craving even more startup goodness, in-depth news analysis, and maybe some extra memes? Click below to upgrade to our premium edition and become the startup guru you were born to be.

Happy Tuesday, folks.

BRICS is VC’s Worst Nightmare

Geopolitical tensions continue to weigh on the startup space, with the friction between China and the United States in particular potentially harming the supply chain of tech products and services, the talent pipeline that flows between the two nations, and the important role that each plays in capital allocation.

The latest casualty of the dick-measuring contest between Biden and Xi is Chinese tech giant Baidu ventures which is now looking to sell off its stake in various US startups to hedge against further deterioration in the relationship between Washington and Beijing.

Baidu isn’t a massive player in the American startup ecosystem, though its American portfolio does contain robotics startup Machina Labs which counts the US Air Force as a customer.

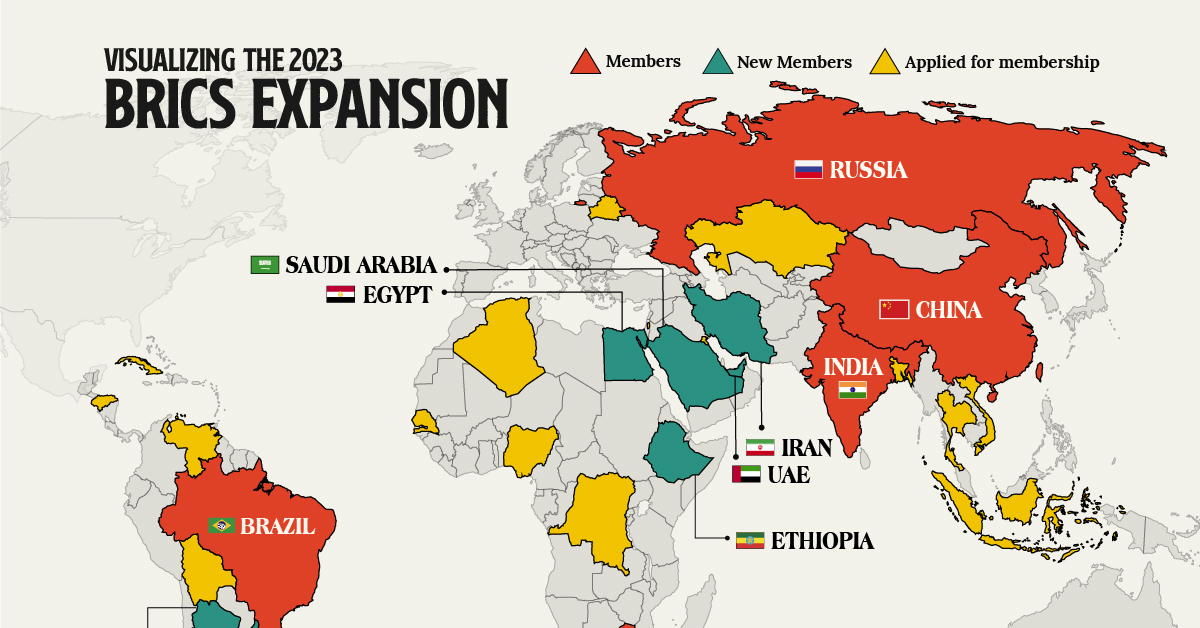

However, the trend is concerning, and the division between the West and East hasn’t been this hostile since the Cold War. The East, led by China, has capitalized on the anti-American sentiment in countries like Russia and Iran.

Credit: Visual Capitalist

The formal alliance between these countrie, BRICS, has experienced impressive traction in limited time. It should concern anyone whose view on the world relies on an US hegemony.

The group aims to end the world’s reliance on the US dollar. The UAE and Russia are already paying off loans in other currencies, and China’s extensive lending throughout the historical Silk Road and Africa position it as an even more important financial figurehead that the United States.

Silicon Valley isn’t a bubble, immune to the decisions being made by politicians around the world. The mostly male, young population of the Bay Area would quite literally be a target for military draft should the need arise.

Further, if you think funding is hard now, you ain’t seen nothing yet. Beyond fewer Chinese investors, good luck trying to get investors to part ways with a penny if the United States officially gets involved militarily with Russia, Iran, or any of the other members of BRICS.

If you’re looking to hedge against this unfortunate situation, look no further than the war stocks, either public companies like $LMT or $PLTR or defense tech startups which are strong candidates for funding from investors and grants directly.

At face value, Baidu’s decision to exit the American venture market isn’t that impactful. However, it’s a stark reminder that despite every “expert” on Twitter calling for the market bottom, there’s still plenty of room to the downside that this market can still explore before things get better.

Geopolitical tensions between China and the US are straining the startup ecosystem, with Baidu Ventures divesting from US startups amid growing East-West hostilities that threaten global financial stability and investment in tech. This reflects broader concerns over supply chains, talent, and capital in an increasingly polarized world.

Love what you're reading? Craving even more startup goodness, in-depth news analysis, and maybe some extra memes? Click below to upgrade to our premium edition and become the startup guru you were born to be.

|

Cheers to another day,

Trey

Reply